The retail giant Walmart has been a staple in the investment portfolios of many, with its stock performance being a topic of interest and analysis. Understanding the impact of consumer trends on Walmart’s stock performance requires a deep dive into the company’s financial health, market performance, and the external factors influencing its trajectory. This article explores the nuances of Walmart’s stock dynamics in the context of evolving consumer behaviors, technological advancements, and market benchmarks.

Key Takeaways

- Walmart’s recent sales growth and operational profit have positively influenced its stock value, showcasing the importance of financial health indicators.

- Technological advancements and efficient operational practices at Walmart, as noted by analysts, play a crucial role in shaping the company’s stock performance.

- Consumer behavior changes and market share gains are pivotal in driving Walmart’s sales and, consequently, its stock trajectory.

- Comparative analysis with major market indexes reveals Walmart’s relative performance, emphasizing the significance of benchmarking against broader market movements.

- Investors should consider the implications of return on equity and profit margins on stock price, as well as the necessity of portfolio diversification for risk management.

Analyzing Walmart’s Financial Health and Market Performance

Impact of Sales Growth and Operating Profit on Stock Value

Let’s cut to the chase: when Walmart’s sales are climbing and the operating profit is looking healthy, it’s like a green light for investors. The buzz around earnings estimates revisions can really get the stock price moving. It’s all about the anticipation, you know? If analysts are tweaking their forecasts upwards, it’s a hint that Walmart’s doing something right, and that’s when you might see the stock price tick up.

But hey, it’s not just about the numbers on a spreadsheet. Valuation matters too. You’ve got to weigh whether the price tag on Walmart’s stock matches up with the company’s real worth and its future cash-making abilities. It’s like checking the price tag on a pair of sneakers and making sure you’re not overpaying for the brand.

Here’s a quick peek at how valuation can play out:

| Valuation Metric | Walmart’s Value | Industry Average |

|---|---|---|

| P/E Ratio | 25.3 | 20.5 |

| P/S Ratio | 0.5 | 0.6 |

| P/CF Ratio | 10.2 | 12.1 |

And remember, while the market might react to news or rumors in the short term, it’s the solid, fundamental factors that steer the ship in the long run. So, keep an eye on those earnings estimates and how they stack up against the competition.

The Role of Market Share and Customer Satisfaction in Stock Dynamics

When it comes to the big players like Walmart, market share and customer satisfaction aren’t just buzzwords—they’re the bread and butter of stock performance. Market share acts as a report card, reflecting how well a company is doing in the competitive schoolyard. But it’s not just about being the biggest kid on the block; it’s about keeping those customers happy. Happy customers mean repeat business, and repeat business means a steadier stream of revenue.

Customer satisfaction is a bit like the secret sauce that keeps investors coming back for more. It’s a sign that a company isn’t just moving products off the shelves but is also creating a positive shopping experience. And let’s face it, in a world where a single tweet can send stock prices tumbling, keeping customers smiling is no small feat. Studies, like the one asking if investments in customer satisfaction lead to excess returns, suggest that satisfied customers can indeed boost returns without hiking up the stock market risk.

In the grand scheme of things, market share and customer satisfaction are intertwined with stock dynamics in a way that can’t be ignored. They’re the pulse that investors check to gauge a company’s health beyond the numbers.

Here’s a quick look at why these factors matter:

- They signal competitive strength and brand loyalty.

- They can lead to increased sales and higher profit margins.

- They provide insight into a company’s long-term growth potential.

Understanding Walmart’s Revenue and Earnings Growth

Let’s dive into the nitty-gritty of Walmart’s financials, shall we? The retail giant’s revenue story is pretty impressive, with the latest quarter ending January 31, 2024, showing a cool $173.39B in the bank. That’s a 5.69% jump from last year, folks! And when you look at the trailing twelve months (ttm), we’re talking about a revenue growth of +6.03%. Now, that’s not too shabby for a company of Walmart’s size, right?

But here’s the kicker: despite a somewhat stagnant net profit from 2006 to 2023, Walmart’s stock has been on a tear, tripling in value and leaving the S&P 500’s 2.5x growth in the dust. So, what gives? It’s like the stock market’s got a crush on Walmart, and it’s not just because of its earnings reports.

Investors are all eyes for Walmart’s upcoming earnings. The forecast? An EPS of $0.52, which would be a sweet 6.12% increase year-over-year. And if we peek at the past, Walmart has been beating those EPS estimates like a champ, three times out of the last four quarters. Plus, they’ve consistently outpaced revenue estimates too. Talk about setting the bar high!

With a P/S ratio that’s looking pretty solid, it’s clear that Walmart isn’t just playing the short game. They’re in it for the long haul, and that’s something investors can get excited about.

So, what’s the bottom line? Walmart’s revenue and earnings growth are more than just numbers on a page. They’re a testament to the company’s ability to adapt, thrive, and keep the cash registers ringing, even when the going gets tough.

Consumer Trends Influencing Walmart’s Stock Trajectory

Technology Adoption and Operational Efficiency

Walmart’s not just about low prices and big stores; it’s also riding the high-tech wave to stay ahead of the game. The retail giant is all in on tech, deploying autonomous forklifts in its distribution centers to crank up productivity and give its workers a break from the heavy lifting. This move is a clear sign of Walmart’s commitment to operational efficiency through technology adoption.

But it’s not just about robots and AI. Walmart’s been keeping its operating expenses on a tight leash since FY2017. The big question is, can they keep trimming that operating expense ratio to beef up their net margin? Here’s a brief look at some figures:

- FY2017: Operating expenses steady

- FY2023: Operating expenses at 20.8% of revenue

Analysts are giving Walmart a thumbs up, pointing out that their tech-savvy approach is paying off with solid sales and profit growth. And let’s not forget, a happy customer is a repeat customer. Walmart’s focus on keeping shelves stocked and checkout lines moving is winning hearts and market share.

With a stable gross margin hovering around 24%, Walmart’s financial health seems robust. But, any significant uptick in operational costs could hit profitability hard. Investors, keep your eyes peeled!

The Effect of Changing Consumer Behavior on Walmart’s Sales

Let’s face it, the pinch of inflation isn’t just a headline; it’s hitting wallets hard. Folks are flocking to Walmart, hunting for bargains to stretch their dollars. Walmart’s sales are climbing, with a 4% uptick in Q4, but it’s not all sunshine and rainbows. Sales are up, sure, but it’s the essentials that are flying off the shelves. General merch? Not so much. It’s a clear sign that consumers are tightening their belts, swapping luxury for necessity.

Analysts are all over this, with Baptista Research giving Walmart a thumbs up for its tech-savvy moves and sales savvy. They’re not just surviving; they’re thriving with a 4.9% sales boost and a 10.9% jump in operating profit. And it’s not just about selling more stuff; it’s about selling smarter, with better stock levels and happier customers.

Omnichannel is the buzzword du jour, and Walmart’s nailing it. They’re beating the estimates, with Walmart US and Sam’s Club US both showing solid comp sales growth. And let’s not forget Sam’s Club’s killer performance in Mexico and China. Talk about global reach!

So, what’s the takeaway for investors? Keep a close eye on those analyst estimates. They’re like a weather vane for Walmart’s business winds. Upward revisions? That’s the analysts’ way of saying they believe in Walmart’s profit-making mojo.

Analyst Estimates and Their Implications for Future Performance

When it comes to the Walmart stock, it’s all about the future, right? Analysts are like fortune tellers with spreadsheets, and their estimates can make or break the market’s mood. The buzz around the future of Walmart stock hinges on these predictions.

Our pals at Zacks have this nifty model that crunches these estimates and spits out a rating. It’s like a weather forecast for stocks, and it’s saying there’s a change in the air. The key takeaway? When analysts get giddy and hike up their earnings estimates, the fair value of Walmart’s stock tends to follow suit, potentially leading to a price jump.

But hey, it’s not just about the numbers game. The real deal is how Walmart adapts to the retail jungle. Are they keeping up with the digital age? Are they innovating like crazy? Because if they are, that’s where the magic happens for revenue growth. And let’s not forget, without revenue growth, earnings growth is just a castle built on sand.

Here’s a thought: While we’re all watching the stock charts, Walmart’s busy making moves in the real world. Those moves? They’re what’s really going to define where the stock heads next.

Comparative Analysis of Walmart Stock Against Market Benchmarks

Walmart’s Performance Relative to Major Market Indexes

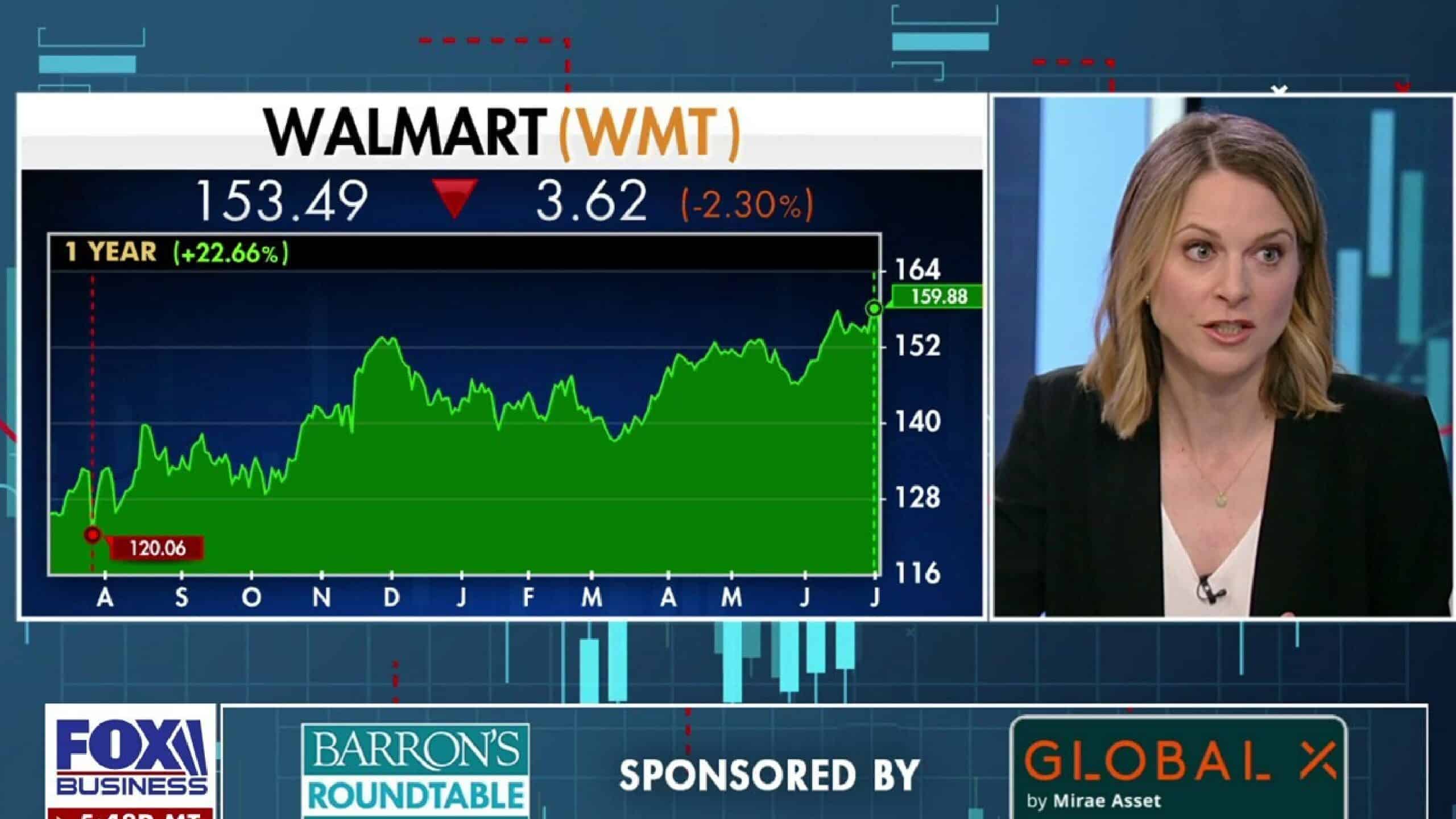

When you’re sizing up Walmart’s stock, it’s super handy to stack it against the big boys of the stock world, like the Dow or NASDAQ Composite. These giants are like the yardsticks of the market, giving us the skinny on how Walmart is doing when the rubber meets the road. Now, there’s this thing called the Macroaxis performance score, which is a number from 0 to 100 that sizes up Walmart’s market mojo from a risk-adjusted return angle. The higher the score, the more Walmart is flexing its muscles compared to other market players.

But here’s the kicker: Walmart’s got a performance score of 14. That’s right, 14 out of a whopping 100. It’s got a market beta of 0.28, which is just a fancy way of saying it doesn’t ride the market waves too hard. So, if the market’s on a tear, Walmart’s gains are more like a jog than a sprint. But hey, when the market’s got the blues, Walmart’s frown isn’t quite as deep.

So, what’s the bottom line? Walmart’s stock might not be the flashiest kid on the block, but it’s got a certain steadiness that could be a safe bet when things get choppy. And with a risk of just 0.84%, it’s like that reliable buddy who’s got your back.

Here’s a quick peek at how Walmart’s been doing lately:

- One Day Return: (0.15%)

- Five Day Return: (0.27%)

- Year To Date Return: 12.69%

Comparing Walmart to the market benchmarks is a bit like checking the scoreboard at halftime. It gives you an idea of who’s winning, who’s got potential, and who might just surprise us all when the game’s over.

Risk-Adjusted Returns and Investor Sentiment

When we talk about risk-adjusted returns, we’re really digging into how much bang for your buck you’re getting, considering the bumps along the way. Walmart’s Sharpe Ratio, sitting at 0.1902, tells us that the returns are not just about the gains but also how smooth the ride was. And let’s be real, nobody likes a bumpy ride, especially when your hard-earned cash is on the line.

Investor sentiment is a tricky beast. It’s like the mood of the market, and it can turn on a dime. Based on technical analysis, which looks at price charts and trading volumes, we can get a sense of this mood. The sentiment can swing from extreme optimism to doom and gloom, impacting stocks like Walmart in a heartbeat.

Based on monthly moving average, Walmart is performing at about 14% of its full potential. Add it to a diversified portfolio, and you could see a nicer, steadier climb without adding too much drama.

Here’s a snapshot of where Walmart stands in the risk-return jungle:

| Metric | Walmart | Market Average |

|---|---|---|

| Sharpe Ratio | 0.1902 | – |

| Estimated Market Risk | 0.84 | – |

| Expected Return | 0.16 | – |

| Risk-Adjusted Return | 0.19 | – |

Remember, these numbers are just a starting point. They’re like the ingredients list on your favorite snack – important, but not the whole story. You gotta look at the big picture to make smart moves.

Historical Stock Performance and Future Outlook

When it comes to Walmart’s historical stock performance, the numbers speak volumes. Over the past decade, the retail giant has shown a ten-year return of 131.13%, with an all-time return reaching a staggering 340.3K%. These figures highlight Walmart’s resilience and adaptability in a competitive market. But what does the future hold for investors eyeing Walmart as one of the strong potential stocks?

Looking ahead, Walmart’s future outlook seems promising. The company’s recent technology adoption and operational efficiency improvements suggest that it’s well-positioned to capitalize on changing consumer behaviors. Moreover, with a forward dividend yield of 1.39% and a payout ratio of 14.61%, Walmart continues to demonstrate its commitment to shareholder returns.

While past performance is no guarantee of future results, Walmart’s stock trajectory has been on an upward trend, indicating a positive momentum that could continue.

However, it’s crucial to compare Walmart’s performance not just in isolation but against market benchmarks. For instance, while Walmart’s year-to-date return stands at 12.69%, it’s essential to consider how this stacks up against major market indexes. This comparative analysis can provide a clearer picture of Walmart’s relative strength in the market.

| Date | Event | Return (%) |

|---|---|---|

| 04/01/2024 | Dividend paid | N/A |

| 04/02/2024 | Trending Stock Buy Now? | N/A |

| 04/10/2024 | N. Va. office building move-in | N/A |

In conclusion, while the historical data is encouraging, investors should keep an eye on market trends and analyst estimates to gauge the potential of Walmart’s stock. After all, in the world of investing, staying informed is key to making savvy decisions.

The Significance of Return on Equity and Profit Margins for Investors

Correlation Between ROE, Profit Margin, and Stock Price

Let’s talk about the magic trio: ROE, profit margin, and stock price. These guys are like the Three Musketeers of the financial world. ROE, or Return on Equity, is a big deal because it gives us a sneak peek into how effectively a company is squeezing profits from its shareholders’ equity. Now, Walmart has been juggling these numbers like a pro, historically outshining the market with its high ROE.

But here’s the kicker: ROE isn’t just a standalone number; it’s got buddies. The net margin and the total asset turnover ratio are part of the ROE squad. Walmart’s net margin has been feeling the heat from rising operating expenses, which is kind of a party pooper for ROE. And if ROE starts to frown, the stock price might catch that frown too.

So, what’s the future looking like? Analysts are eyeballing Walmart’s inventory turnover and total asset turnover ratio, which have been steady Eddie’s over the years. But with consumer trends shifting faster than a chameleon on a disco ball, Walmart’s got to stay on its toes. Speaking of staying agile, check out this tidbit: Exide strengthens EV battery business, sparking joy in investors and nudging stock prices up. Could this be a crystal ball moment for Walmart’s future revenue growth, especially with a focus on EV batteries? Only time will tell.

Analyzing Net Margin Trends and Their Impact on Share Value

Let’s talk about Walmart’s net margin trends and how they play ball with the stock value. Net margins are like the financial health report card for a company—they show what’s left after all the bills are paid. For Walmart, keeping an eye on these margins is crucial because even a small dip can mean big news for investors.

Now, you might wonder, why do these margins matter so much? Well, they’re a key indicator of efficiency and profitability. A shrinking margin can signal that costs are rising faster than sales, and that’s not what we want to see. It’s like Walmart is running harder but not getting as far. And when margins tighten, it can put the squeeze on the stock value.

Here’s a snapshot of how Walmart’s net margin has been shaping up:

| Year | Net Margin % |

|---|---|

| 2022 | 3.5% |

| 2023 | 3.3% |

| 2024 | 3.1% |

As you can see, there’s been a slight but steady decline. This is where investors start getting antsy, wondering if this trend will continue and what it means for their wallets. The drop in Walmart’s net margin, which has outpaced the growth of share buyback and dividend payments, seems to explain why Walmart’s ROE has been declining.

In the grand scheme of things, net margins might not seem like a big deal, but to the trained eye, they’re a beacon signaling the company’s future prospects.

Investor Considerations for Walmart’s Financial Ratios

When you’re sizing up Walmart’s stock, it’s not just about the numbers. Sure, diving into the financial statements gives you the hard facts, but don’t forget the softer side of things. Company management, corporate governance, and ethical practices can make or break investor confidence just as much as the cold, hard cash figures.

Here’s a quick peek at some of the valuation ratios that can tell you if you’re getting a bang for your buck with Walmart:

| Ratio Type | Walmart’s Ratio |

|---|---|

| Price-to-Earnings | P/E Ratio |

| Price-to-Sales | P/S Ratio |

| Price-to-Book | P/B Ratio |

Evaluating Walmart’s stock isn’t a one-size-fits-all kind of deal. It’s a blend of art and science, mixing quantitative digs with qualitative insights.

Remember, it’s not just about whether Walmart’s stock is up or down today. It’s about understanding the ecosystem and where Walmart fits in the grand scheme of things. Comparing it to its peers can shed light on whether the stock is a hidden gem or a polished pebble.

Strategic Insights for Portfolio Diversification and Risk Management

The Importance of Diversifying Investments Beyond Walmart

When it comes to investing, putting all your eggs in one basket can be a risky move. Diversifying your portfolio is key to managing risk and aiming for steady returns over time. Walmart might be a giant in the retail space, but it’s not immune to market fluctuations and industry-specific risks. That’s why it’s smart to spread your investments across different sectors and asset classes.

Investing in Walmart should be part of a broader strategy that includes a mix of stocks, bonds, real estate, and perhaps even some commodities or crypto. Consider your investing portfolio as a team, with distinct roles for each member. Walmart might be your steady defender, but you’ll also need some agile midfielders and sharpshooters to win the game.

By diversifying, you’re not just protecting yourself against the volatility of a single stock, but also positioning your portfolio to capture growth from multiple sources.

Remember, diversification isn’t just about having a variety of stocks; it’s about having investments that react differently to the same economic events. This way, when one part of your portfolio dips, another might rise, balancing out the overall impact.

Assessing the Downside Risk and Upside Potential of Walmart Stock

When you’re eyeing Walmart stock, it’s like checking out a new gadget; you gotta know what you’re getting into. Is the juice worth the squeeze? That’s the million-dollar question. You’ve seen Walmart pull off a 15% return recently, but hey, if the rest of the market is partying at 25%, you might feel like you’re missing out. So, let’s stack it up against the big boys like the Dow and NASDAQ Composite to see how it holds its own.

Now, if you’re a numbers person, you’ll want to dive into the risk-adjusted performance stats. Walmart’s sitting at a modest 14 out of 100, which isn’t exactly the top of the class. But don’t write it off just yet. There’s chatter about Walmart hitting a sweet spot that could send shares climbing in May 2024. Here’s a quick peek at the recent numbers:

| Performance Metric | Value (%) |

|---|---|

| One Day Return | (0.15) |

| Five Day Return | (0.27) |

| Year To Date Return | 12.69 |

It’s not just about the numbers, though. You’ve got to feel out the vibe of the company. How’s Walmart doing in the trenches? Are they keeping up with the times, staying profitable, and growing? These are the soft signals that can hint at whether Walmart’s stock is ready to soar or if it’s gearing up for a nosedive.

Lastly, don’t forget to tap into the wisdom of the crowd. Analyst opinions and ratings can give you the scoop on whether Walmart’s stock is the next hot ticket or if it’s overhyped. It’s like getting a sneak peek into the future of your investment.

Evaluating the Momentum Score in the Context of Retail Industry Trends

When it comes to the retail game, momentum can be a real game-changer. Walmart’s got a Momentum score of 4, which is like a high-five from the market, signaling that it’s riding the wave of market trends and investor love pretty well. This score reflects how Walmart is vibing with the current retail scene, and it’s a handy number to keep in your back pocket when you’re trying to figure out where the stock might head next.

But hey, let’s break it down a bit more. The Smartkarma Smart Scores give us a peek into Walmart’s overall mojo. With a composite score of 3.2, it’s like a report card that says ‘doing good, but room to grow’. Here’s a quick snapshot:

| Factor | Score |

|---|---|

| Magnitude | 3 |

| Value | 3 |

| Dividend | 3 |

| Growth | 3 |

| Resilience | 3 |

| Momentum | 4 |

So, what’s the takeaway? Walmart’s not just chilling; it’s actually making moves that resonate with the current retail vibes. And with a solid score in Momentum, it’s got that extra pep in its step that could mean good things for investors looking for a steady player in the retail space.

Keep an eye on the Momentum score, as it can give you a heads-up on whether Walmart is likely to keep up with its historical performance or if it’s time to buckle up for a different ride.

In the ever-evolving world of finance, strategic portfolio diversification and risk management are key to safeguarding your investments. At CourtingNews.com, we provide cutting-edge insights and analysis to help you make informed decisions. Whether you’re interested in the latest tech stocks or seeking the hidden gems in the market, our expert guidance is just a click away. Don’t miss out on the opportunity to empower your portfolio with our exclusive content. Visit CourtingNews.com today to unlock your financial potential!

Conclusion

In summary, Walmart’s stock performance is intricately linked to consumer trends, operational efficiencies, and market sentiment. Despite facing challenges such as fluctuating net margins and ROE, Walmart has demonstrated resilience through sales growth, market share gains, and robust technology adoption.

Analysts at Baptista Research remain bullish, citing these strengths alongside the company’s positive risk-adjusted performance and momentum score. However, investors must consider broader market benchmarks and maintain a diversified portfolio to mitigate risks.

As Walmart continues to navigate the retail landscape, its fundamentals, including revenue growth and profit margins, will be crucial in shaping its stock trajectory. Ultimately, while Walmart’s stock has potential, it is subject to the dynamic interplay of various internal and external factors that investors should closely monitor.

Frequently Asked Questions

What recent financial performance figures are notable for Walmart?

Walmart demonstrated strong performance with a sales growth of 4.9% and adjusted operating profit growth of 10.9% in constant currency, along with higher transaction counts and unit volumes.

How do analysts view Walmart’s stock performance?

Analysts at Baptista Research are bullish on Walmart, citing robust technology adoption for operational efficiency among other major drivers. Upward revisions in estimates also express analysts’ positivity towards Walmart’s business operations.

Why is it important to compare Walmart’s stock performance to market benchmarks?

Comparing Walmart’s stock performance to market benchmarks like the Dow or NASDAQ Composite helps investors evaluate its relative performance and determine if it’s keeping pace with or outperforming the general market.

What is the significance of Walmart’s Momentum score?

With a Momentum score of 4, Walmart shows strong performance in terms of market trends and investor sentiment, indicating its solid position in the retail industry.

How does Walmart’s Return on Equity (ROE) impact its stock price?

Historically, Walmart’s stock price has correlated with its ROE. High ROE periods saw the stock price doubling and outperforming the S&P 500 index while declining ROE periods saw the stock price leveling off with the index.

Why is diversification beyond Walmart stock important for investors?

Diversification is crucial to mitigate risk as it reduces reliance on the performance of a single company. Investors need to spread their investments across different assets to protect against volatility in Walmart’s stock.

3 thoughts on ““Investing in the Retail Giant: Why Walmart Stock Is the New Wall Street Sensation”{2024}”